Earnings Not Telling The Tale For Beijing CTJ Facts Know-how Co., Ltd. (SZSE:301153)

Table of Contents

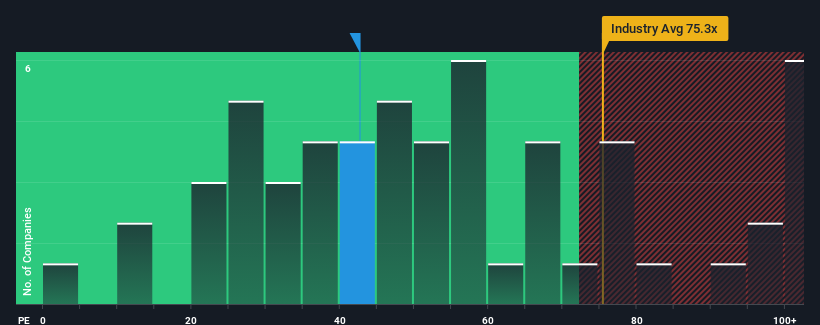

With a value-to-earnings (or “P/E”) ratio of 42.7x Beijing CTJ Data Technological know-how Co., Ltd. (SZSE:301153) may be sending bearish indicators at the minute, provided that pretty much half of all organizations in China have P/E ratios below 30x and even P/E’s lessen than 18x are not unusual. Nevertheless, we’d will need to dig a little deeper to identify if there is a rational basis for the elevated P/E.

With earnings advancement which is top-quality to most other corporations of late, Beijing CTJ Facts Technologies has been carrying out relatively effectively. It would seem that several are expecting the strong earnings functionality to persist, which has lifted the P/E. If not, then current shareholders could be a minor anxious about the viability of the share price tag.

Look at out our hottest analysis for Beijing CTJ Data Technology

If you would like to see what analysts are forecasting going forward, you ought to examine out our no cost report on Beijing CTJ Facts Technological know-how.

How Is Beijing CTJ Data Technology’s Progress Trending?

In order to justify its P/E ratio, Beijing CTJ Information and facts Technologies would want to deliver amazing expansion in surplus of the marketplace.

Retrospectively, the previous yr shipped a respectable 3.8% get to the firm’s base line. The latest a few yr time period has also witnessed an fantastic 80% over-all rise in EPS, aided rather by its quick-expression overall performance. Thus, it is really honest to say the earnings advancement not too long ago has been superb for the enterprise.

Wanting in advance now, EPS is expected to climb by 25% throughout the coming calendar year in accordance to the four analysts pursuing the business. With the industry predicted to supply 38% progress , the company is positioned for a weaker earnings end result.

In light of this, it truly is alarming that Beijing CTJ Details Technology’s P/E sits earlier mentioned the bulk of other companies. Apparently a lot of buyers in the organization are way much more bullish than analysts indicate and usually are not eager to allow go of their stock at any rate. You can find a great chance these shareholders are placing them selves up for foreseeable future disappointment if the P/E falls to levels more in line with the growth outlook.

The Base Line On Beijing CTJ Info Technology’s P/E

Applying the cost-to-earnings ratio alone to ascertain if you should really market your inventory just isn’t reasonable, having said that it can be a useful tutorial to the firm’s potential potential clients.

We have founded that Beijing CTJ Data Engineering at present trades on a significantly increased than expected P/E since its forecast advancement is lower than the broader sector. When we see a weak earnings outlook with slower than market place expansion, we suspect the share selling price is at danger of declining, sending the high P/E lessen. Unless these conditions enhance markedly, it truly is quite demanding to accept these prices as remaining sensible.

Lots of other essential chance things can be discovered on the company’s balance sheet. Our free equilibrium sheet evaluation for Beijing CTJ Info Technologies with six simple checks will permit you to learn any dangers that could be an issue.

Of system, you may also be capable to obtain a greater stock than Beijing CTJ Information Technologies. So you could wish to see this totally free assortment of other corporations that have sensible P/E ratios and have grown earnings strongly.

Valuation is sophisticated, but we are serving to make it very simple.

Obtain out irrespective of whether Beijing CTJ Facts Know-how is most likely above or undervalued by checking out our comprehensive examination, which includes reasonable value estimates, risks and warnings, dividends, insider transactions and monetary wellbeing.

See the Cost-free Examination

Have comments on this report? Worried about the material? Get in touch with us right. Alternatively, e mail editorial-workforce (at) simplywallst.com.

This posting by Merely Wall St is normal in nature. We give commentary dependent on historic knowledge and analyst forecasts only employing an unbiased methodology and our article content are not intended to be monetary information. It does not constitute a suggestion to obtain or offer any stock, and does not just take account of your aims, or your financial problem. We intention to provide you extended-time period focused examination pushed by fundamental data. Take note that our analysis may possibly not factor in the newest selling price-delicate company announcements or qualitative materials. Only Wall St has no placement in any shares described.